Today I read Paul Krugman writing about the paradox of thrift. As is often the case, I found it interesting to read and to notice the assumptions that Krugman bases his positions on. While anyone can go read what he wrote I’ll give a quick overview of the paradox of thrift – increases in personal savings can have an adverse effect on the economy causing a net decrease in actual savings overall.

The first assumption made by Krugman is that savings come in the form of currency with an assigned value but with no real intrinsic value – paper money. If savings come in the form of debt reduction or in acquiring real goods for future use then a bad economy increases the value of the savings rather than decreasing that value.

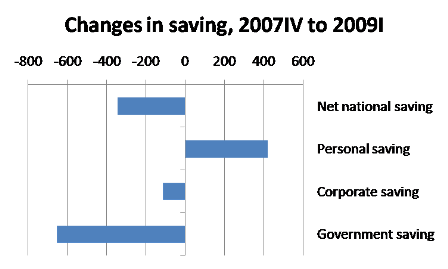

The second assumption made by Krugman is that government should be a significant force and substantial contributor to the economy. This is a man who argued that the government was doing the wrong thing and not enough of it when Obama got his stimulus bill passed (ARRA). While I often disagree with his assumptions I absolutely trust Krugman to be able to read the numbers and do his math so I won’t attempt to do my own numbers. I will link to the source of his numbers and then play with his graph to show how things look under new assumptions.

First, let’s see what the net savings has been over the same period if the government had not decided to intercede:

Suddenly the net savings is extremely positive over the same period if we can assume that the bailouts and stimuli were not necessary or desirable. In other words, the paradox of thrift is “proven” by the fact that the government incurred more new debt than individuals were able to save.

On the other hand, what if the stimuli and/or bailouts were necessary or at least what if they had some positive effect on the economy? I’ll be generous to the government (and conservative with corporate efficiency) and imagine that the increase in government debt had twice as much positive effect on the economy than the decrease in corporate savings. (Anyone, even Krugman, would have to admit that government is not exactly a bastion of efficiency.) In that case, if we were to triple the decrease in corporate savings to offset the lack of our ever-burgeoning government debt while keeping the economy as stable as it has been so far we get this graph:

Even if we are to accept everything we have been told about the economy and the necessity of intervention, the private sector could have accomplished as much as government without a net loss in total savings. Considering that the economy is as bad – after the stimulus and bailouts have had months to start working – as it was projected to be without those extra-constitutional efforts (remember that unemployment was not supposed to go above 8% after ARRA and it was supposed to get to 10% by the end of the year without it) I think we canse safely question much of what we have been told about the economy by people who are perpetually wrong as they “misread how bad the economy was.”

Leave a Reply